BPC理财平台最新消息

Title: Understanding BPC Financial Management in Xi'an

Understanding BPC Financial Management in Xi'an

Xi'an, the ancient capital of China, is not only rich in history and culture but also home to a thriving financial sector. In this article, we delve into the world of BPC (Business Process Outsourcing) financial management in Xi'an, exploring its significance, key practices, and offering guidance for those navigating this field.

BPC financial management refers to the outsourcing of various financial processes, including accounting, bookkeeping, payroll management, and financial analysis, to thirdparty service providers. This approach allows companies to focus on their core competencies while ensuring efficient and accurate financial operations.

Xi'an has emerged as a hub for BPC services, attracting both domestic and international businesses seeking costeffective and reliable financial management solutions. The city's strategic location, skilled workforce, and supportive business environment have contributed to its prominence in this sector.

1.

Comprehensive Financial Analysis

: BPC firms in Xi'an offer indepth financial analysis services, helping businesses gain valuable insights into their financial performance and make informed decisions.

2.

Risk Management

: With the increasing complexity of financial markets, effective risk management is crucial. BPC providers in Xi'an assist companies in identifying and mitigating various financial risks, ensuring stability and resilience.

3.

Regulatory Compliance

: Compliance with financial regulations is nonnegotiable for businesses. BPC firms in Xi'an stay updated with the latest regulatory requirements and ensure that their clients adhere to them, avoiding legal complications.

4.

Cost Efficiency

: Outsourcing financial management to BPC providers in Xi'an offers significant cost savings compared to maintaining an inhouse finance team. This cost efficiency is particularly beneficial for startups and small to mediumsized enterprises.

1.

Define Clear Objectives

: Before engaging BPC services, clearly define your financial objectives and expectations. Communicate these to your service provider to ensure alignment.

2.

Select a Reliable Partner

: Choose a BPC firm with a proven track record of excellence and reliability. Conduct thorough research, seek recommendations, and evaluate their expertise in your industry.

3.

Establish Effective Communication Channels

: Maintain open and transparent communication with your BPC provider. Regular updates and feedback sessions are essential for a successful partnership.

4.

Monitor Performance

: Continuously monitor the performance of your BPC provider to ensure that they meet agreedupon standards. Address any issues promptly to maintain service quality.

5.

Stay Informed

: Keep yourself updated on developments in the financial management landscape. This knowledge will enable you to make informed decisions and adapt to changing circumstances.

BPC financial management plays a pivotal role in the success of businesses in Xi'an, offering a range of benefits including efficiency, expertise, and cost savings. By understanding the key practices and following the guidance outlined in this article, businesses can maximize the value derived from BPC services and achieve their financial objectives effectively.

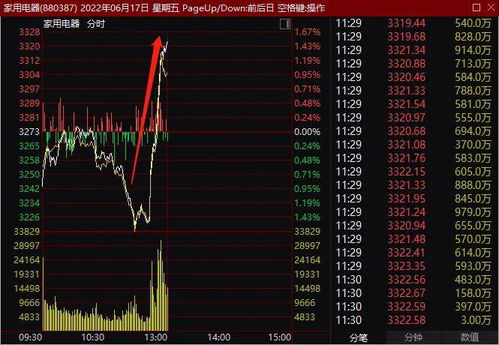

股市动态

MORE>- 搜索

- 最近发表

-

- 深度解析,股票000977——挖掘未来投资价值的密码

- 宋佳在三页剧本中演绎百变情感,100多条的挑战与突破

- 深度解析,000153——揭秘这只潜力股的未来走向

- 东北大爷虎口脱险,一场意外背后的中韩文化交流盛宴

- 73岁王石独自带娃,展现父爱如山的另一面

- 揭秘000816,一只引领稳健增值的蓝筹金牛

- 宋仲基的双倍幸福,二胎女儿的温馨降临

- 探索西部建设的未来引擎,002302,推动中国西部崛起的新力量

- 虎鲨吞噬手机,一探究竟的第一视角记录

- 探索科技界的隐形冠军,兄弟科技,你的智能生活守护者

- 甘肃教育厅正核实小蜜蜂老师身份

- 深度解析——金融街,投资者的黄金地带与市场风向标

- 关宏峰被抓2小时,7年后才放出来

- 揭秘300042朗科科技,从光存储到智能驱动的创新旅程

- 深度解析,中国平安601318——你的长期稳健投资伙伴

- 胖东来员工购房新政策,责任与担当的实践

- 点亮未来之光,探索300102乾照光电的神奇科技之旅

- 医院CT等收费新规解读

- 揭秘钢铁世界的智慧引擎——探析300226上海钢联的行业影响力与未来展望

- 临沂巨响揭秘,神秘事件引发关注

- 深度解析,解读000718——探寻股市中的稳健白马股之路

- 78岁老太减持2.5亿股股票

- 揭秘601628中国人寿,守护国民财富的稳健力量

- 罕见之苹果首次曝光中国开发者收入

- 深度解析,华谊兄弟的转型之路与行业启示——探秘中国影视巨头的起落与未来展望

- 女子替丈夫讨薪泪洒匍匐地

- 深度解析,601857——中国建筑的稳健力量,投资者必看的行业趋势与投资策略

- 深度解析,探秘002436这只潜力股的崛起之路——从基本面到市场动态

- 关晓彤白玉兰荣耀时刻

- 春华秋实 打一个生肖_辅助分析解答:1182.3D.A31

- 名列前茅打一个生肖_精彩对决解析_实用版131.225

- 卡在这里打一个生肖:全面的解释解答-2024年10月/13_251.D9

- 要有承担勿累事_猜一生肖一句引发热议_网页版v038.073

- 卧虎成龙_引发热议与讨论_V32.99.87

- 鼠肚鸡肠打一个生肖_最佳精选解释落实:910.ISO.077

- 一码打一个生肖_最新答案解释落实_安装版v188.332