疫情期间股票哪些行业好

Title: Strategies for Stock Incentives During a Pandemic

During a pandemic, motivating employees through stock incentives can be a valuable strategy for companies to retain talent and drive performance. However, the approach needs to be adapted to the unique challenges and uncertainties posed by the crisis. Let's explore some effective strategies for utilizing stock incentives during these times:

1. Transparent Communication:

Transparently communicate the company's current situation, challenges, and longterm vision to employees. This fosters trust and helps employees understand the rationale behind stock incentive programs, especially during uncertain times.

2. Flexibility in Stock Options:

Offer flexible stock option plans that accommodate employees' changing financial needs and risk tolerance during the pandemic. This may include adjusting the exercise price, extending exercise windows, or providing cashless exercise options.

3. PerformanceBased Grants:

Tie stock grants to performance metrics that are relevant and achievable even in remote work settings. This could include meeting specific revenue targets, achieving costsaving goals, or successfully launching new products/services adapted to the current market needs.

4. Employee Stock Purchase Plans (ESPPs):

Implement or enhance ESPPs to allow employees to purchase company stock at a discounted price, providing them with a tangible stake in the company's success. This can also improve employee engagement and alignment with shareholder interests.

5. Restricted Stock Units (RSUs):

Consider granting RSUs with vesting periods aligned with the company's recovery timeline or milestones. This ensures that employees remain committed to the organization's longterm success despite shortterm uncertainties.

6. Employee Assistance Programs:

Offer financial planning and counseling services to help employees navigate the complexities of stock incentives, especially during times of financial stress. This can include education on tax implications, diversification strategies, and estate planning.

7. Recognition and Appreciation:

Recognize and appreciate employees for their contributions and resilience during challenging times. Publicly acknowledging employees who have achieved significant milestones or exceeded expectations can reinforce the value of stock incentives as a form of recognition and reward.

8. Regular Reviews and Adjustments:

Continuously review and adjust stock incentive programs based on evolving business conditions, employee feedback, and regulatory changes. Flexibility and adaptability are key to ensuring that these programs remain effective and relevant during a pandemic.

9. Emphasize LongTerm Value:

Emphasize the longterm value of stock incentives as a tool for wealth accumulation and retirement planning, rather than shortterm financial gains. This helps employees stay focused on the bigger picture and encourages a mindset of stewardship and loyalty towards the company.

10. Legal and Compliance Considerations:

Ensure that all stock incentive programs comply with relevant legal and regulatory requirements, especially in light of any changes or exemptions introduced during the pandemic. Seek guidance from legal and financial experts to mitigate risks and ensure compliance.

In conclusion, leveraging stock incentives during a pandemic requires a balanced approach that addresses both shortterm challenges and longterm objectives. By adopting transparent communication, flexibility, performancebased criteria, and a focus on employee wellbeing, companies can effectively motivate and retain talent during these unprecedented times.

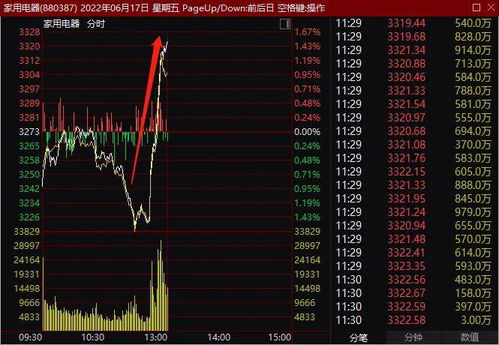

股市动态

MORE>- 搜索

- 最近发表

-

- 深度解析,股票000977——挖掘未来投资价值的密码

- 宋佳在三页剧本中演绎百变情感,100多条的挑战与突破

- 深度解析,000153——揭秘这只潜力股的未来走向

- 东北大爷虎口脱险,一场意外背后的中韩文化交流盛宴

- 73岁王石独自带娃,展现父爱如山的另一面

- 揭秘000816,一只引领稳健增值的蓝筹金牛

- 宋仲基的双倍幸福,二胎女儿的温馨降临

- 探索西部建设的未来引擎,002302,推动中国西部崛起的新力量

- 虎鲨吞噬手机,一探究竟的第一视角记录

- 探索科技界的隐形冠军,兄弟科技,你的智能生活守护者

- 甘肃教育厅正核实小蜜蜂老师身份

- 深度解析——金融街,投资者的黄金地带与市场风向标

- 关宏峰被抓2小时,7年后才放出来

- 揭秘300042朗科科技,从光存储到智能驱动的创新旅程

- 深度解析,中国平安601318——你的长期稳健投资伙伴

- 胖东来员工购房新政策,责任与担当的实践

- 点亮未来之光,探索300102乾照光电的神奇科技之旅

- 医院CT等收费新规解读

- 揭秘钢铁世界的智慧引擎——探析300226上海钢联的行业影响力与未来展望

- 临沂巨响揭秘,神秘事件引发关注

- 深度解析,解读000718——探寻股市中的稳健白马股之路

- 78岁老太减持2.5亿股股票

- 揭秘601628中国人寿,守护国民财富的稳健力量

- 罕见之苹果首次曝光中国开发者收入

- 深度解析,华谊兄弟的转型之路与行业启示——探秘中国影视巨头的起落与未来展望

- 女子替丈夫讨薪泪洒匍匐地

- 深度解析,601857——中国建筑的稳健力量,投资者必看的行业趋势与投资策略

- 深度解析,探秘002436这只潜力股的崛起之路——从基本面到市场动态

- 关晓彤白玉兰荣耀时刻

- 春华秋实 打一个生肖_辅助分析解答:1182.3D.A31

- 名列前茅打一个生肖_精彩对决解析_实用版131.225

- 卡在这里打一个生肖:全面的解释解答-2024年10月/13_251.D9

- 要有承担勿累事_猜一生肖一句引发热议_网页版v038.073

- 卧虎成龙_引发热议与讨论_V32.99.87

- 鼠肚鸡肠打一个生肖_最佳精选解释落实:910.ISO.077

- 一码打一个生肖_最新答案解释落实_安装版v188.332