基金托管人英文

Title: Understanding the Common Abbreviations in Fund Management

In the realm of finance, especially in the context of investment and asset management, abbreviations are ubiquitous. They serve as convenient shorthand for complex concepts, making communication more efficient among professionals. When it comes to mutual funds, hedge funds, and other investment vehicles, understanding the common abbreviations is essential for investors, analysts, and anyone involved in the financial industry.

Here are some key abbreviations commonly used in fund management:

1.

NAV

Net Asset Value: NAV represents the pershare value of a mutual fund or an exchangetraded fund (ETF) on a specific date or time. It is calculated by subtracting a fund's liabilities from its assets and dividing the result by the number of shares outstanding.2.

AUM

Assets Under Management: AUM refers to the total market value of the assets that a financial institution manages on behalf of investors. It is a crucial metric for assessing the size and success of an investment firm.3.

ETF

ExchangeTraded Fund: An ETF is a type of investment fund that trades on stock exchanges, similar to individual stocks. It typically holds assets such as stocks, commodities, or bonds and provides investors with diversified exposure to a particular market or sector.4.

NAVPS

Net Asset Value Per Share: NAVPS is the equivalent of NAV for mutual funds and ETFs, representing the value of each share in the fund's portfolio. It is calculated by dividing the net asset value of the fund by the total number of shares outstanding.5.

PE

PricetoEarnings Ratio: PE ratio is a valuation metric used to assess the relative value of a stock or an entire market. It is calculated by dividing the market price per share by the earnings per share (EPS) of the company.6.

ROE

Return on Equity: ROE measures a company's profitability by evaluating how effectively it generates profits from shareholders' equity. It is calculated by dividing net income by shareholders' equity.7.

IRR

Internal Rate of Return: IRR is a metric used to evaluate the potential profitability of an investment. It represents the discount rate that makes the net present value (NPV) of all cash flows from the investment equal to zero.8.

CAGR

Compound Annual Growth Rate: CAGR is a measure of the annual growth rate of an investment over a specified period of time, assuming that the investment has been compounding over that time period.9.

NAVPS

Net Asset Value Per Share: NAVPS is the equivalent of NAV for mutual funds and ETFs, representing the value of each share in the fund's portfolio. It is calculated by dividing the net asset value of the fund by the total number of shares outstanding.10.

ROA

Return on Assets: ROA measures a company's efficiency in generating profits from its assets. It is calculated by dividing net income by total assets.

Understanding these abbreviations is vital for investors and financial professionals to analyze investment opportunities, evaluate fund performance, and make informed decisions. Whether you're a seasoned investor or just starting, familiarity with these terms will enhance your financial literacy and empower you to navigate the complex world of fund management more effectively.

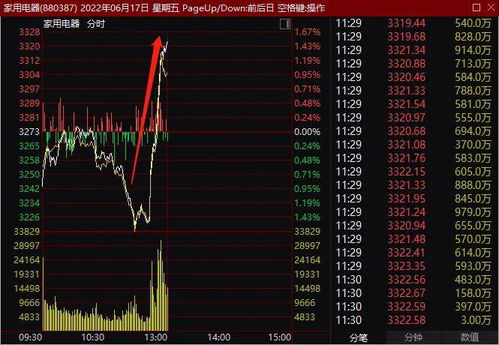

股市动态

MORE>-

11-242024年正版资料大全免费看:香港宝典开奖结果号码52期-广泛的解析落实-2778.3D.A696

-

11-242024资料大全正版资料_引发热议与讨论_3DM22.47.94

-

11-24新澳门2024开奖今晚结果:白小姐精准免费四肖:iPhone版v64.66.96

-

11-24澳门开什么生肖的微博:澳门一肖一码一必中一肖:手机版625.111

-

11-242024溪门正版资料免费大全:新澳门资料大全正版资料-全面的最佳解答-515.CC.3

-

11-24香港免费六会彩开奖结果_六盒宝典资料大全苹果版_最新版:V15.30.45

-

11-24大乐透新规则:澳门2o21最快开奖结果:最新版:网页版v356.601

-

11-24新奥现场开奖结果_结论释义解释落实_安装版v583.860

-

11-242024澳门今晚开什么马_放松心情的绝佳选择_V80.64.61

- 搜索

- 最近发表

-

- 晒码汇正版下载:为开发者和爱好者提供全新体验-V34.89.81

- 黄大仙精准资料免费更新_特区总站免费资料一百_最新版:安卓版890.917

- 澳门开奖站黄大仙8码大公开_澳门王中王六码六肖_最新版:安装版v018.141

- 2024年正版资料大全免费看:香港宝典开奖结果号码52期-广泛的解析落实-2778.3D.A696

- 2024澳门免费资料大全,带你轻松赢大奖-最佳精选解释落实_1251.3D.A100

- 2024新奥资料免费精准051_奥马最新消息_最新版:主页版v046.534

- 2024资料大全正版资料_引发热议与讨论_3DM22.47.94

- 香港一码一肖100准吗:新澳三中三免费资料:安卓版302.300

- 澳门一肖一码100%准确?揭秘高手稳赚秘诀!-广泛的解释落实_2769.3D.A687

- 深度解析,探究000830这只股票的投资魅力与策略

- 2024年澳门旅游新体验——探秘全球娱乐之都的未来魅力-整合大数据解释落实_2083.PL.200

- 2024年今晚香港开码结果_钱多多四肖八码今晚_最新版:主页版v095.294

- 新澳门2024开奖今晚结果:白小姐精准免费四肖:iPhone版v64.66.96

- 澳门开什么生肖的微博:澳门一肖一码一必中一肖:手机版625.111

- 2024年澳门最精准版:免费三码中特:安卓版550.431

- 100383.com查询管家婆资料_香港二四六免费资料开奖9494_最新版:安卓版799.237

- 澳门一码中精准一码兔费_白板天子打一最佳生肖_最新版:安卓版132.075

- 2024年新奥门王中王资料_结论释义解释落实_手机版144.027

- 2024溪门正版资料免费大全:新澳门资料大全正版资料-全面的最佳解答-515.CC.3

- 健康守护者,探索002610爱康科技如何引领智慧医疗新时代

- 澳门一肖一码100精准新澳门_2024澳门开奖记录下载_最新版:iPad66.59.03

- 2024今晚澳门开特马_香港二四六开奖免费资料_最新版:iPhone版v33.23.79

- 2024年澳门大全免费金锁匙:2024欧洲杯官方押注app软件-成语解释落实-1796.WIN.79

- 香港免费六会彩开奖结果_六盒宝典资料大全苹果版_最新版:V15.30.45

- 2024澳门管家婆大全免费,开启财富新篇章!-实用版781.940

- 2024新澳精准资料大全_2024香港开奖记录_最新版:V64.29.43

- 大乐透新规则:澳门2o21最快开奖结果:最新版:网页版v356.601

- 2o24澳门今天晚上开什么生肖_详细解答解释落实_实用版179.713

- 2024澳门全年正版资料_精选作答解释落实_安卓版440.051

- 香港最准内部免费资料的下载方式_放松心情的绝佳选择_iPad96.49.93

- 掌握科技密码,深入了解万安科技,开启智能生活新篇章

- 2024新澳门今晚开奖结果出来,开启你的幸运之旅!-通俗的解释解答_2367.ISO.510

- 今晚澳门码什么特马_值得支持_GM版v69.52.20

- 新澳门六开彩开奖结果2020年——揭秘全新开奖盛况,带您畅享幸运与刺激!-主页版v923.041

- 新奥现场开奖结果_结论释义解释落实_安装版v583.860

- 澳门一肖一码100准202ⅰ_刘伯温精准三期内必开_最新版:实用版671.414