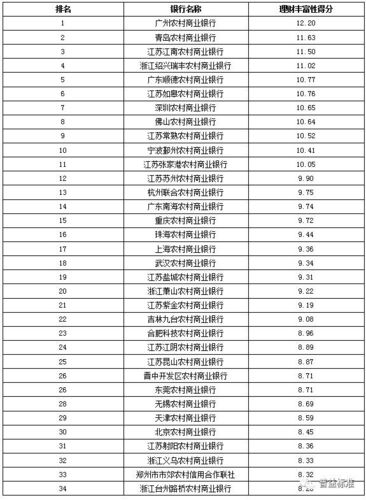

保本理财哪家银行好

Title: Understanding Beijing's Guaranteed Investment Products

In recent years, guaranteed investment products have gained popularity among investors seeking stability and security for their funds. Beijing, as a financial hub in China, offers a variety of options in this regard. Let's delve into the concept of guaranteed investment products and explore how they function within the context of Beijing's financial landscape.

What are Guaranteed Investment Products?

Guaranteed investment products are financial instruments that promise to return the principal amount invested along with a predetermined rate of return, irrespective of market fluctuations. These products are designed to provide investors with a lowrisk option for wealth preservation while offering modest returns.

Types of Guaranteed Investment Products in Beijing

1.

Bank Deposits

: Traditional bank deposits, such as fixed deposits and savings accounts, are among the most common forms of guaranteed investment products. Banks in Beijing offer competitive interest rates and various maturity options to cater to different investor preferences.2.

Structured Deposits

: Structured deposits combine fixedincome investments with derivatives to offer potentially higher returns than traditional deposits. These products often guarantee the principal amount while linking the interest earned to the performance of underlying assets, such as stock indices or currencies.3.

Trust Products

: Trust companies in Beijing provide a range of guaranteed investment products, including trust schemes with capital protection features. These products pool funds from multiple investors and invest in a diversified portfolio to generate returns while minimizing risk.4.

Insurance Products

: Some insurance companies offer guaranteed investmentlinked insurance products (GILIPs), which provide both life insurance coverage and investment opportunities. These products guarantee a minimum return on the investment component while offering the potential for higher returns through marketlinked investments.Key Considerations for Investors

1.

Risk Profile

: Before investing in guaranteed products, investors should assess their risk tolerance and investment objectives. While these products offer capital protection, they may provide lower returns compared to riskier investment options.2.

Interest Rates and Terms

: Different products offer varying interest rates, maturity periods, and liquidity terms. Investors should compare the terms offered by different financial institutions in Beijing to find the most suitable option for their needs.3.

Regulatory Environment

: Beijing's financial market is subject to regulations imposed by regulatory authorities such as the China Banking and Insurance Regulatory Commission (CBIRC). Investors should ensure that the products they choose comply with regulatory requirements to safeguard their interests.4.

Inflation Consideration

: While guaranteed products provide capital preservation, investors should also consider the impact of inflation on the real value of their returns over time. Inflationlinked products or diversification into other asset classes may help mitigate this risk.Conclusion

Beijing offers a diverse range of guaranteed investment products catering to investors' need for capital preservation and steady returns. By understanding the types of products available, assessing their riskreturn profiles, and considering regulatory factors, investors can make informed decisions to safeguard their wealth and achieve their financial goals in the dynamic financial landscape of Beijing.

Invest wisely, prioritize capital protection, and stay informed about market developments to navigate Beijing's financial markets effectively.

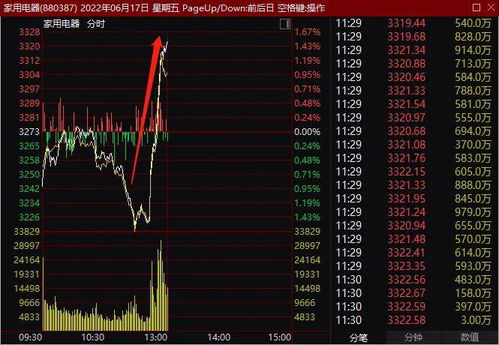

股市动态

MORE>- 搜索

- 最近发表

-

- 汽车模具创新工艺及加工方式集合

- 燃油车难道真的将要退出历史舞台?

- “二孩”时代来临 钱准备好了吗?请从长计议 华声在线郴州频道

- 深度解析与投资攻略,探秘国电电力的电力帝国之路

- 深度解析,600165新日恒力,转型之路与未来展望

- 探索金融蓝筹,走进兴业证券601377,解锁财富增长新引擎

- 掌握未来能源,深度解析智光电气——引领电力智能化转型的行业先锋

- 探索绿色海洋,解读海南瑞泽,开启环保投资新里程

- 海洋巨擘的力量,解锁中集集团000039的海洋经济密码

- 驾驭未来,探索无限可能——深入了解600066宇通客车的创新与实力

- 掌握未来金融趋势,深度解析银信科技——探索数字化转型的金融引擎

- 掌握开开实业投资秘籍,深度解析与实用建议

- 探索未来城市绿脉,解读合肥城建002208的建筑蓝图

- 深度解析,000862银星能源,能源转型下的隐形明珠

- 探索振东制药,深度解析与投资指南

- 太原重工,砥砺前行的制造业巨擘——深度解析600169的行业实力与投资价值

- 疫苗守护者,解锁华兰生物002007的创新力量与健康密码

- 深度解析,獐子岛的逆袭之路——从扇贝危机到海洋生态复苏的启示

- 掌握通信密码,深入解析600498烽火通信的数字化转型之路

- 深度解析,国星光电,光电子行业的隐形冠军,未来增长点在哪里?

- 揭秘云翔天际,走进白云机场600004背后的运营与未来发展

- 深度解析西宁特钢,钢铁巨擘的稳健之路——走进西宁特钢股票的世界

- 揭秘航天电子,中国航天科技新引擎,600879背后的科技实力与市场潜力

- 深度解析,苏泊尔002032,厨电巨头的转型之路与投资价值探析

- 驾驶未来,深度解析600335国机汽车,开启智能汽车新篇章

- 探秘健康守护者,中国医药600056的行业力量与未来展望

- 探索600794保税科技,一座隐形的贸易宝库——深度解析与投资攻略

- 深度解析,滨江集团,城市的璀璨明珠,稳健发展的房地产旗舰

- 探索医学科技的新明珠,理邦仪器——精准医疗时代的导航者

- 探秘超市之王,好当家600467,您的智慧购物管家

- 探秘电子界的隐形冠军,002436兴森科技——连接创新与未来的桥梁

- 深度解析,解读000537广宇发展的转型之路与投资机遇

- 探索未来通信的新赛道,走进盛路通信002446的科技之旅

- 聚焦未来科技巨头,零零二三一五——焦点科技引领数字化转型的创新探索

- 深度解析,达华智能,数字化转型中的行业引领者——探索AI科技对未来家居的革命

- 智能家居的厨房新宠儿——揭秘002508老板电器的魅力