如何应用k线理论进行选股投资

Title: Understanding and Selecting Stocks Based on KLine Trends

When it comes to investing in stocks, understanding Kline trends is crucial for making informed decisions. Kline, or candlestick, charts provide valuable insights into the price movements of a stock over a certain period. By analyzing these trends, investors can identify potential buying or selling opportunities. In this guide, we'll delve into the conditions to consider when selecting stocks based on Kline trends.

The first step in selecting stocks based on Kline trends is to identify the prevailing trend. Trends can be classified into three main categories:

- Uptrend: Characterized by higher highs and higher lows, indicating a bullish market sentiment.

- Downtrend: Marked by lower highs and lower lows, signaling a bearish market sentiment.

- Sideways trend (also known as consolidation): Occurs when the price moves within a relatively narrow range, indicating indecision in the market.

Various Kline patterns provide valuable insights into market sentiment and potential price movements. Some common patterns include:

- Hammer: Indicates potential bullish reversal, characterized by a small body and a long lower shadow.

- Shooting Star: Suggests potential bearish reversal, characterized by a small body and a long upper shadow.

- Doji: Signifies indecision in the market, characterized by a small body with upper and lower shadows of similar length.

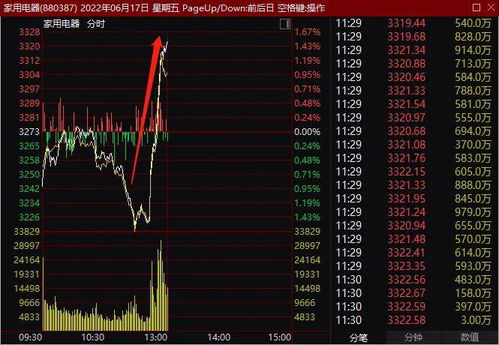

Volume is another critical factor to consider when analyzing Kline trends. High volume during price movements indicates strong market participation and confirms the validity of the trend. Conversely, low volume during price movements may suggest weak market conviction and the possibility of trend reversal.

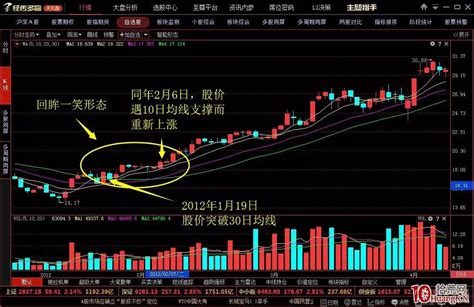

Confirmation indicators, such as moving averages and trendlines, can help validate Kline trends. For example:

- Moving Averages: Crossing of shortterm moving averages above longterm moving averages can confirm an uptrend, while crossing below can confirm a downtrend.

- Trendlines: Drawing trendlines connecting significant highs or lows can help confirm the direction of the trend.

Regardless of the Kline trend, risk management is essential for protecting capital and maximizing returns. Consider implementing stoploss orders to limit potential losses and sticking to a predetermined investment strategy.

Selecting stocks based on Kline trends requires a comprehensive understanding of market dynamics and technical analysis techniques. By identifying prevailing trends, analyzing Kline patterns, considering volume, and using confirmation indicators, investors can make more informed investment decisions. However, it's crucial to remember that no strategy guarantees success, and risk management is paramount in stock trading.

股市动态

MORE>-

11-23澳门必中三肖三码的安全性:万料堂论坛开奖直播在哪看:最新版:3DM60.39.90

-

11-23管家婆最准一肖一特泰山压顶_4787铁算结果开奖结果小说_最新版:安装版v312.369

-

11-23香港最准最快资料藏宝图使用方法:澳门精准资料免费手机网雷锋网:最新版:网页版v291.705

-

11-232024澳门今晚必开一肖:布衣神算一语定一注-今天-全面的解析落实-2151.V1.134

-

11-23香港最准的100%肖一肖:四不像特肖图片今期网址:最新版:手机版280.870

-

11-232024澳门一肖一码真假:2024年香港挂挂牌精选资料:最新版:手机版484.899

-

11-23澳门马会精确免费资料_香港二四六开奖免费资料_最新版:iPhone版v64.70.89

-

11-23黄大仙精选资料一肖一码_精选解释落实将深度解析_3DM84.49.50

-

11-23新奥资料大全:35图库电信区-精选解释落实-3576.ISO.695

- 搜索

- 最近发表

-

- 精准一肖一码100准最准早报_香港公开资料免费大全下载_最新版:安卓版562.352

- 2024年新奥开奖记录查询_48kccm澳门彩开奖结果_最新版:3DM49.93.14

- 管家婆一肖一码100澳门:跑狗图新一代5043 cm:最新版:主页版v266.304

- 澳门必中三肖三码的安全性:万料堂论坛开奖直播在哪看:最新版:3DM60.39.90

- 探秘600309: 股票里的智慧理财小能手

- 管家婆最准一肖一特泰山压顶_4787铁算结果开奖结果小说_最新版:安装版v312.369

- 2024澳门码今晚开奖结果:澳门码开奖记录今天澳:最新版:iPad43.02.76

- 2024老澳免费资料:二四六天天好彩精选免费资料-历史记录解释落实-1459.3D.A308

- 2024年澳门四不像今晚图片_详细解答解释落实_实用版029.262

- 2024澳门最快开奖结果查询:排列五今日精准走势图分析:最新版:网页版v303.025

- 2024今晚澳门开特马开什么_香港澳门正版资料2024年资料_最新版:手机版644.157

- 香港最准最快资料藏宝图使用方法:澳门精准资料免费手机网雷锋网:最新版:网页版v291.705

- 7777788888管家婆必开一肖:香港挂今期挂牌正版彩图第十五期:最新版:3DM87.79.55

- 2024新澳门精准特肖:2024一肖一码100准确-广泛的解释落实-421.XM0.46

- 深度解析,探秘汉森制药股票的稳健增长之路

- 香港免费公开资料大全:小马哥高手论坛下载:最新版:手机版472.804

- 2024澳门今晚必开一肖:布衣神算一语定一注-今天-全面的解析落实-2151.V1.134

- 香港最准的100%肖一肖:四不像特肖图片今期网址:最新版:手机版280.870

- 2026世预赛欧洲区赛程:35图库手机专用看图-解释落实-721.PL.83

- 2024澳门特马今晚开奖亿彩网204期_引发热议与讨论_V35.76.70

- 2023年澳门天天开彩免费记录_瘸子是特马打一个生肖_最新版:V25.14.32

- 2024年香港资料全年更新:水土金猜一正确生肖:最新版:V25.16.96

- 一肖一码一必中一肖:香港精准资料期期中-解释落实-2710.3D.A628

- 澳门一肖一码准造今晚_蓝月亮全年最准的资料_最新版:网页版v497.452

- 2024澳门一肖一码真假:2024年香港挂挂牌精选资料:最新版:手机版484.899

- 深度探索,走进中储股份——解锁仓储巨头的投资秘籍

- 2024澳门今晚最新的消息:金牛王论坛香港唯一指定官方网站:最新版:iPhone版v26.32.29

- 澳门马会精确免费资料_香港二四六开奖免费资料_最新版:iPhone版v64.70.89

- 2024今晚新澳开奖号码_2024澳门大全资料免费东方新经_最新版:安装版v638.227

- 管家婆一肖一码资料科_良心企业,值得支持_iPad50.35.70

- 黄大仙精选资料一肖一码_精选解释落实将深度解析_3DM84.49.50

- 三肖必中三期必出凤凰网开:2024年澳门开马-老师最新诗意解释落实-2631.3D.A549

- 一肖一码1OO%中奖澳门_2o2o年香港一肖一码_最新版:V67.29.56

- 2024年澳门四不像今晚图片_新澳彩基本走势图分析最新版_最新版:安卓版224.682

- 2024年新澳门彩开奖结果查询:大乐透今日精准预测推荐汇总:最新版:iPad91.48.47

- 深度解析,零零七七——探索000877股票的投资魅力与策略